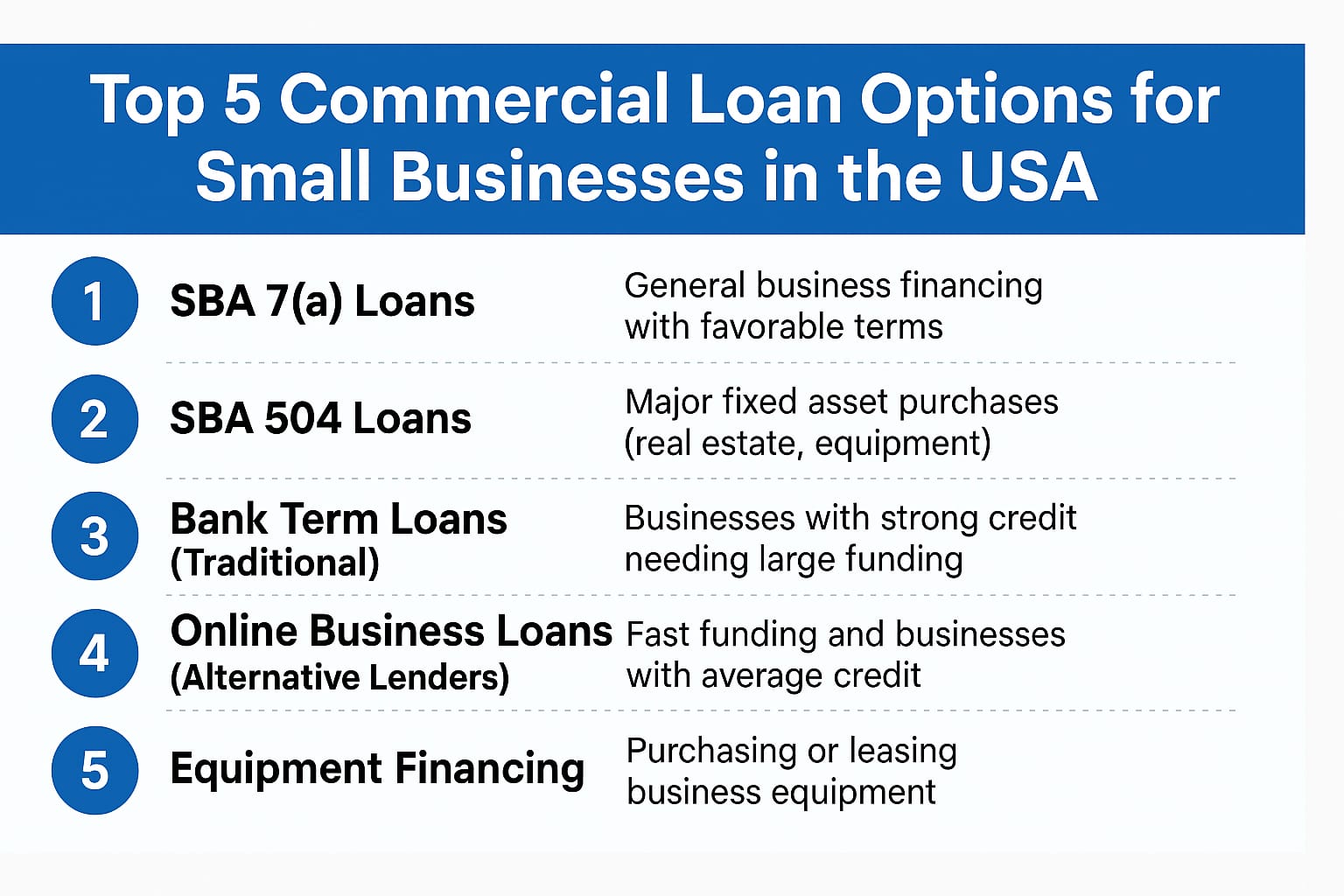

Top 5 Commercial Loan Options for Small Businesses in the USA – Big Financing Deals

For small businesses across the United States, finding the right commercial loan can mean the difference between scaling successfully or stalling growth. With 2025 bringing tighter markets and more specialized lending options, it’s crucial for entrepreneurs to understand the most profitable funding strategies available today.

1. SBA 7(a) Loans – The Most Popular Federal Funding Option

The SBA 7(a) loan is backed by the U.S. Small Business Administration and is one of the most sought-after financing tools. Businesses can borrow up to $5 million with terms up to 25 years. Its relatively low-interest rates (around 6-9%) and flexible eligibility make it an excellent option for startups and expanding businesses alike.

What makes the SBA 7(a) loan appealing is the low down payment requirement and government-backed guarantee that makes lenders more comfortable with risk.

2. Equipment Financing – Perfect for Manufacturers and Retailers

When small businesses need to purchase expensive machinery or technology, equipment financing comes into play. In most cases, the equipment itself acts as collateral. This reduces lender risk and increases the approval rate.

This type of financing is especially popular in industries like agriculture, healthcare, construction, and retail. Lenders typically offer terms that match the life expectancy of the equipment, which is helpful for budgeting and ROI calculations.

3. Invoice Factoring and Merchant Cash Advance

Struggling with cash flow while waiting for customer payments? Invoice factoring offers a solution by allowing businesses to sell their unpaid invoices at a discount in exchange for immediate cash. This is ideal for B2B companies with long payment cycles.

A merchant cash advance (MCA) gives you a lump sum in exchange for a percentage of future credit card sales. It’s a fast but high-cost funding solution and typically appeals to restaurants and retail businesses.

4. Business Line of Credit – Flexible Financing for Ongoing Needs

A business line of credit allows companies to draw funds when needed, only paying interest on the amount used. This is one of the most versatile financing products, suitable for covering payroll, inventory, or emergency expenses.

Many lenders now offer unsecured lines of credit for small businesses with good credit history and strong revenue. Interest rates vary but can be competitive if your business is financially healthy.

5. Commercial Real Estate Loans – For Purchasing or Refinancing Property

For businesses looking to buy a storefront, office space, or expand warehouse operations, commercial real estate loans are ideal. These long-term loans often offer fixed interest rates and terms up to 30 years.

These loans require significant documentation, including business plans, income projections, and property details. However, they are one of the few types of financing that build equity in tangible assets.

Key Benefits of High-CPC Commercial Loan Keywords

- Best business loan rates USA

- Low interest small business loans

- Unsecured business funding 2025

- Fast business loan approvals online

- Top lenders for commercial property loans

These keywords represent topics with high advertiser demand. When integrated naturally into content, they help drive organic and paid traffic to finance-related websites.

Conclusion

In 2025, U.S. small businesses have more financing options than ever before. Whether you’re seeking a low-risk SBA 7(a) loan, a fast merchant cash advance, or long-term real estate financing, understanding each tool’s benefits and limitations is key.

Consult with certified financial advisors and compare lenders online to find the right loan structure for your specific business goals.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Please consult a licensed advisor before making any financial decisions.